Giving Priorities

Learn about key areas at the University that you can show your support.

Learn more

Learn about key areas at the University that you can show your support.

Learn more

From making an online donation to gift of securities to planning your legacy, there are many ways you can make a contribution to the University.

Learn More

We recognize our donors in various ways for their involvement with the University. Learn more about one of our four Giving Societies and how you can join today.

Learn more

The Memorial Display provides a peaceful place to memorialize and celebrate deceased members of the University community.

Learn moreAlumni

of undergraduate students were awarded financial aid in 2020-21

Giving Societies

Alumni Benefits Available

The Charger Blog

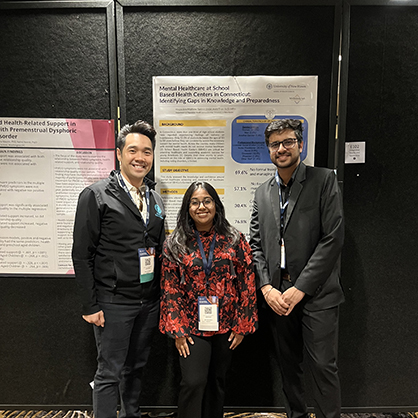

Sanmit Jindal ’24 MPH and Krupa Ann Mathew ’24 MPH collaborated with each other and with their faculty mentors as they gathered data at one academic conference and presented their findings at another. It was an exciting opportunity to explore research, to network, and to examine adolescent mental health.

The Charger Blog

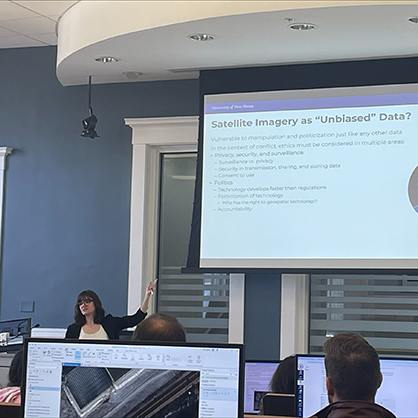

Satellite imagery is becoming an increasingly valuable tool in many fields, and several Chargers recently had the opportunity to learn how to apply it to do everything from tracking the conflict in Ukraine to determining whether images had been tampered with.

The Charger Blog

After she graduates with her bachelor’s degree in international affairs in May, Allison Mahr ’24 will head to the Republic of Georgia with the support of a Boren National Security Fellowship. She’s excited to use the award to build her skills and, ultimately, make an impact in the post-conflict reconstruction of the region.

Leadership isn’t always about title or position. If we know what to look for, we can find examples of leadership in many forms across the University community in our students, faculty, staff, alumni, and friends. Read more about some of these special individuals, as well as Dr. Zenger’s own perspective on leadership, in this issue.